In an era where innovation is key to maintaining competitiveness, businesses across the United Kingdom are increasingly turning to artificial intelligence (AI) to enhance their operations. One area experiencing significant transformation is tax filing. With the complexities involved in tax compliance and the rising volume of data, the integration of AI into tax processes offers a promising solution. This article explores the multifaceted benefits of employing AI in streamlining the UK’s tax filing processes.

Revolutionizing Tax Data Management

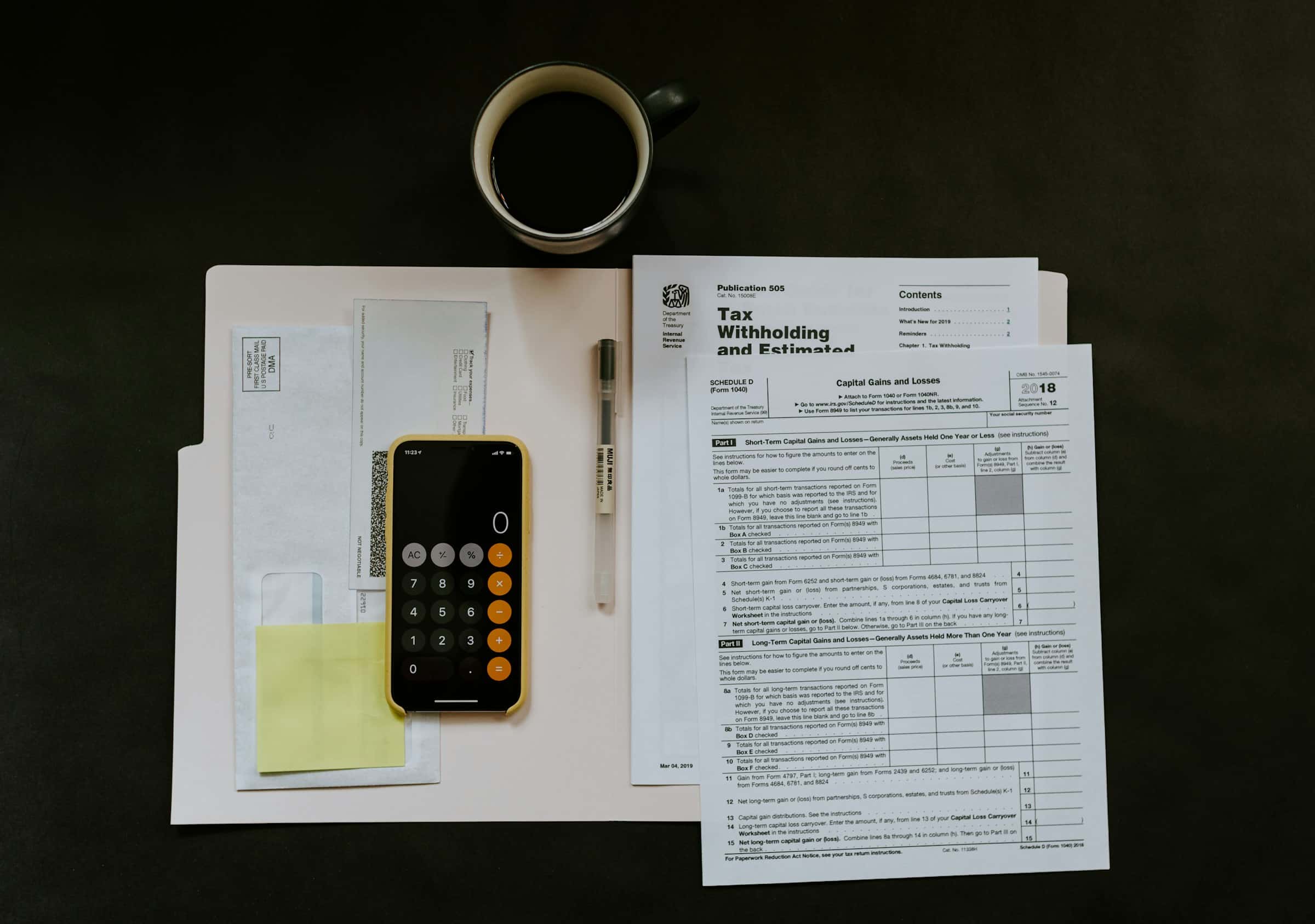

Artificial intelligence has immense potential in transforming how tax data is managed and utilized. In traditional systems, data entry is a labor-intensive task prone to errors. AI-driven tax software can help alleviate these issues through automation. By efficiently handling vast amounts of information, these systems ensure accuracy and reduce the workload for tax professionals.

Avez-vous vu cela : How Can AI Enhance the Interactive Experiences in UK Museums?

AI algorithms can sift through complex datasets, recognizing patterns and extracting relevant information with unmatched precision. This capability significantly enhances the tax preparation process, allowing for more comprehensive and reliable compliance. AI’s machine learning abilities enable it to learn and adapt, improving over time as it encounters different data sets and scenarios.

For accounting firms, this means a substantial reduction in man-hours spent on routine tasks, freeing up resources for more strategic activities. The integration of AI into their operations can also provide a competitive edge, as they can offer more reliable and efficient services to their clients.

A lire aussi : How Can AI Enhance the Operational Efficiency of UK’s Postal Services?

Moreover, the UK government has been supportive of pro innovation initiatives, encouraging businesses to adopt advanced technology. By utilizing AI, business owners can ensure that their tax functions are not only compliant but also optimized for efficiency.

Enhancing Accuracy and Reducing Errors

Accuracy is paramount in tax filing. Even minor errors can lead to significant financial penalties and complications. AI solutions excel at process streamlining by minimizing human error. They analyze data meticulously, cross-referencing it against multiple sources to ensure every detail is correct.

Traditionally, tax professionals would manually input data, calculate figures, and verify information. This method, while thorough, is inherently prone to human error. AI reduces the margin for mistakes by automating these tasks. For instance, by employing optical character recognition (OCR) technology, AI systems can accurately extract data from physical documents and input it into digital systems without error.

The long term benefits of this accuracy extend beyond immediate tax filing. Businesses can maintain cleaner, more reliable financial records, which is crucial for decision making and strategic planning. By minimizing the need for error correction, AI systems also save time and costs associated with potential government audits and compliance issues.

Additionally, global businesses operating in the UK stand to benefit significantly from AI’s ability to handle complex tax regulations across different jurisdictions. By ensuring compliance with both UK and international tax laws, AI solutions simplify the process for multinational businesses.

Optimizing the Tax Compliance Process

The tax compliance landscape is continually evolving, with new regulations and requirements being introduced regularly. Keeping up with these changes can be challenging for businesses. AI and machine learning technologies offer a dynamic solution by continuously updating themselves with the latest regulatory changes.

By integrating AI into their tax functions, businesses can ensure they remain compliant without the need for constant manual updates. Companies like H&R Block and Wolters Kluwer are leveraging AI to automate compliance checks, ensuring their clients adhere to the latest tax laws and regulations. This automation not only reduces the risk of non-compliance but also enhances the efficiency of the tax filing process.

Furthermore, AI can provide predictive insights, helping businesses anticipate future tax liabilities and plan accordingly. This capability is particularly beneficial for menu industries and other sectors with fluctuating revenues. By forecasting tax obligations, businesses can manage their finances more effectively, avoiding last-minute scrambles and potential penalties.

The UK government will support such advancements, recognizing the potential of AI to streamline tax compliance and improve overall efficiency. For tax professionals, this means a shift towards more advisory roles, as the routine aspects of tax compliance are handled by AI systems.

Improving Decision-Making and Strategic Planning

Beyond merely handling data and ensuring compliance, AI brings a higher level of intelligence to the tax function. The ability of AI systems to analyze vast amounts of data and generate actionable insights is a game-changer for businesses. These insights can help companies make informed decisions, optimize operations, and strategically plan for the future.

For instance, AI can analyze historical tax data to identify trends and patterns that might not be obvious through manual analysis. This deeper understanding allows businesses to optimize their tax strategies, identify potential savings, and better manage their resources. The application of AI in this context goes beyond tax compliance, contributing to overall business intelligence.

Accounting professionals can leverage these insights to provide more valuable advice to their clients. Rather than focusing on data entry and number crunching, they can interpret the insights generated by AI systems to guide business decisions. This shift not only enhances the role of accounting firms but also adds significant value to their clients.

The long-term impact of AI on decision-making and strategic planning is profound. By providing accurate, timely, and actionable insights, AI empowers businesses to navigate the complexities of the tax landscape with greater confidence and agility. This capability is especially crucial in a global economy, where businesses must adapt quickly to changing regulations and market conditions.

Facilitating Automation and Efficiency

One of the most significant benefits of AI in tax filing is its ability to automate routine tasks, enhancing overall efficiency. Automation reduces the burden on human resources, allowing businesses to focus on more strategic and value-added activities. This shift is particularly relevant for tax accounting firms that handle high volumes of data and require precise and timely processing.

AI-driven tax software can automate various aspects of the tax filing process, from data collection and entry to calculation and submission. This end-to-end automation ensures that the entire process is streamlined, reducing the risk of delays and errors. Moreover, it allows businesses to handle larger volumes of data without compromising on accuracy or efficiency.

The menu services industry, for example, can benefit greatly from such automation. With fluctuating revenues and complex tax requirements, AI can simplify tax filing by automatically processing transactions and ensuring compliance. This capability not only saves time but also reduces the need for extensive manual intervention.

Furthermore, AI’s ability to continuously learn and adapt means that these systems become more efficient over time. As they process more data and encounter different scenarios, AI systems refine their algorithms, enhancing their accuracy and reliability. This continuous improvement is a significant advantage for businesses looking to optimize their tax functions.

By embracing AI, business owners can ensure that their tax processes are not only compliant but also highly efficient. The time saved through automation can be redirected towards strategic initiatives, driving growth and innovation. In the context of a rapidly evolving business environment, the ability to adapt and innovate is crucial for long-term success.

The integration of AI into the UK’s tax filing processes offers numerous benefits, from enhanced accuracy and reduced errors to optimized compliance and improved decision-making. By automating routine tasks and providing actionable insights, AI empowers businesses to navigate the complexities of tax filing with greater confidence and efficiency.

As we move forward, the role of AI in tax accounting will continue to evolve, offering even more advanced capabilities and solutions. For businesses, this means staying ahead of the curve and leveraging the latest technological advancements to ensure compliance and drive growth.

In summary, the adoption of AI in tax filing is not just a trend but a strategic move towards a more efficient and intelligent future. As the UK government supports pro-innovation initiatives, businesses that embrace AI will be well-positioned to thrive in a dynamic and competitive landscape.